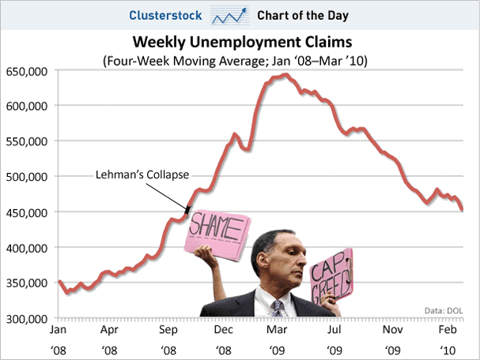

Seekingalpha has a chart that shows how the collapse of Lehman Brothers caused massive unemployment. The bankruptcy of Lehman Brothers was the beginning of the economic crisis that was felt around the world.

(chart from Seekingalpha)

This is how Ohio lost so many jobs.

CBS News (September 15, 2009):

Among the most pervasive and long-lasting effects of the Lehman Brothers failure — and the economic collapse it exemplified — has been the pain felt by the American labor force. When the firm failed on September 15, 2008, and the credit markets slammed shut, a wave of sheer panic swept across businesses big and small as they scrambled to shore up lines of credit and gird for what most believed would be a significant economic downturn. The result: What had been a relatively predictable and gradual rise in unemployment since the beginning of the recession in December 2007 became a hemorrhage as the unemployment rate jumped from 6.2 percent that September to 9.7 percent a year later. Over the past year, about 6 million Americans have lost their jobs. Another 9 million find themselves in the category of involuntary part-time workers, a jump of 3.7 million in just over 12 months. The economy must create 125,000 jobs a month just to stay even with population growth, according to the U.S. Bureau of Labor Statistics (BLS), and clearly, it's not....

....As the numbers suggest, it is male-dominated professions that have been hit hardest — manufacturing has lost 1.2 million jobs in the year since Lehman vanished, and since the start of the recession, construction has given up 1.4 million and the financial industry dropped 537,000.....

Kasich brags about his "business" experience. However, his business experience involved his work as an investment banker at Lehman Brothers. Is this the type of experience Ohioans want? With a bankrupt company? The failure of Lehman Brothers caused the loss of jobs, but also the loss of retirement funds, investments, and a sense of security for millions of people. What were the ethics practiced at Lehman that resulted in the company's collapse, and the economic disaster that followed?

:) Did you know that Rep. Mary Jo Kilroy (OH-15-Democrat) was a co-sponsor of the Lilly Ledbetter Fair Pay Act? Here is Kilroy's statement about the passage of the bill:

“Ending pay discrimination is an issue of fairness and an issue for our families. I am proud to stand with Lilly Ledbetter and thousands of women that were victims of a wage gap only because they were women. Restoring the legal remedies for those affected by this injustice helps break down the disparities between men and women in the workplace that continue to exist, but this Congress has made the rights of all workers a priority...."

Do you know which Ohio Republicans voted against this bill that will help "...thousands of women that were victims of a wage gap only because they were women. Restoring the legal remedies for those affected by this injustice helps break down the disparities between men and women in the workplace..."---(they voted against women having the right to equal pay and their right to sue to get it)????

These are the Ohio Republicans who voted against legal remedies for women who had been paid less than men, just because they were women:

Steve Austria, John Boehner, Jim Jordan, Steve Latourette, Bob Latta, Jean Schmidt, Pat Tiberi, and Michael Turner

Jean Schmidt and any woman in the House of Representatives that voted against the "Lilly Ledbetter Fair Pay" bill.)

-> Sen. Scott Brown, Republican/Tea Party darling, was in town to appear with candidate, Steve Stivers, a former "top"* bank lobbyist and protege of John Boehner. Brown and Stivers both were against Wall Street reform. Do they support predatory lending, investment firms selling toxic assets, and the rip off of retirees and pension funds? Why do these two politicians stand against consumer protection?????